The art of deal making in investment banking

The Importance of Negotiation Skills in Investment Banking Deal Making

The world of investment banking is a complex and fast-paced environment, where deals are made and fortunes are won or lost. In this high-stakes arena, negotiation skills play a crucial role in the success of investment banking deal making. The ability to negotiate effectively can make the difference between a lucrative deal and a missed opportunity.

Negotiation skills are essential for investment bankers because they enable them to navigate the intricate web of financial transactions. Investment banking deals involve multiple parties with competing interests, and negotiating the terms that satisfy all parties is no easy task. It requires a deep understanding of the financial markets, as well as the ability to analyze and interpret complex data.

One of the key reasons why negotiation skills are so important in investment banking deal making is the need to strike a balance between risk and reward. Investment bankers must carefully assess the potential risks associated with a deal and negotiate terms that mitigate these risks while maximizing the potential for profit. This requires a keen eye for detail and the ability to identify potential pitfalls before they become major obstacles.

Another reason why negotiation skills are crucial in investment banking deal making is the need to build and maintain relationships with clients. Investment bankers often work with the same clients on multiple deals, and the ability to negotiate effectively can help establish trust and credibility. Clients are more likely to work with investment bankers who can deliver favorable outcomes and negotiate deals that align with their goals.

In addition to building relationships with clients, negotiation skills are also important for investment bankers when dealing with other parties involved in a deal, such as lawyers, regulators, and other financial institutions. These parties often have their own agendas and interests, and negotiating with them requires a delicate balance of assertiveness and diplomacy. Investment bankers must be able to advocate for their clients’ interests while also finding common ground with other parties to reach mutually beneficial agreements.

Furthermore, negotiation skills are essential for investment bankers when it comes to structuring deals. Investment banking deals can be highly complex, involving intricate financial instruments and legal frameworks. Negotiating the terms of these deals requires a deep understanding of the underlying financial concepts and the ability to communicate and explain these concepts to all parties involved. Investment bankers must be able to articulate their clients’ needs and objectives in a way that is clear and persuasive.

In conclusion, negotiation skills are of utmost importance in investment banking deal making. They enable investment bankers to navigate the complex world of financial transactions, strike a balance between risk and reward, build and maintain relationships with clients, and negotiate with other parties involved in a deal. The art of deal making in investment banking requires a combination of analytical thinking, financial expertise, and effective communication. Investment bankers who possess strong negotiation skills are well-positioned to succeed in this challenging and rewarding field.

Strategies for Successful Deal Making in Investment Banking

The art of deal making in investment banking is a complex and intricate process that requires a deep understanding of the financial markets, strong negotiation skills, and the ability to build and maintain relationships with clients. Successful deal making in investment banking involves a combination of strategic planning, careful analysis, and effective communication.

One of the key strategies for successful deal making in investment banking is thorough preparation. Before entering into any deal, investment bankers must conduct extensive research and analysis to understand the market dynamics, industry trends, and the financial health of the companies involved. This preparation allows investment bankers to identify potential risks and opportunities, and develop a comprehensive strategy to maximize value for their clients.

Another important strategy for successful deal making is effective communication. Investment bankers must be able to clearly articulate the value proposition of a deal to their clients and other stakeholders. This requires strong presentation and negotiation skills, as well as the ability to build trust and credibility with clients. Effective communication also involves active listening and understanding the needs and objectives of all parties involved in the deal.

Building and maintaining relationships is another critical aspect of successful deal making in investment banking. Investment bankers must cultivate strong relationships with clients, as well as with other professionals in the industry. These relationships are built on trust, integrity, and a track record of delivering results. By establishing a strong network of contacts, investment bankers can access a wider pool of potential clients and opportunities, increasing their chances of success in deal making.

Flexibility and adaptability are also important strategies for successful deal making in investment banking. The financial markets are constantly evolving, and deal structures and terms may need to be adjusted to accommodate changing circumstances. Investment bankers must be able to think on their feet and adapt their strategies to meet the needs of their clients and the market. This requires a deep understanding of the financial markets, as well as the ability to analyze and interpret complex data and information.

Finally, successful deal making in investment banking requires a focus on long-term value creation. Investment bankers must not only consider the immediate financial gains of a deal, but also the long-term strategic implications for their clients. This involves evaluating the synergies and potential risks associated with a deal, and advising clients on the best course of action to achieve their long-term objectives. By taking a holistic approach to deal making, investment bankers can help their clients create sustainable value and achieve their strategic goals.

In conclusion, the art of deal making in investment banking requires a combination of strategic planning, effective communication, relationship building, flexibility, and a focus on long-term value creation. Successful deal making involves thorough preparation, clear and persuasive communication, and the ability to adapt to changing circumstances. By employing these strategies, investment bankers can increase their chances of success in deal making and deliver value for their clients.

Ethical Considerations in Deal Making within the Investment Banking Industry

The investment banking industry is known for its high-stakes deal making. Investment bankers are constantly working to secure lucrative deals for their clients, whether it be mergers and acquisitions, initial public offerings, or debt financing. However, in the pursuit of these deals, ethical considerations often come into play. This article will explore the ethical considerations in deal making within the investment banking industry.

One of the primary ethical considerations in deal making is the duty to act in the best interest of the client. Investment bankers have a fiduciary duty to their clients, meaning they must prioritize their clients’ interests above their own. This duty requires investment bankers to provide honest and unbiased advice, disclose any conflicts of interest, and ensure that the terms of the deal are fair and reasonable for their clients.

Conflicts of interest can arise in deal making, and investment bankers must navigate these situations carefully. For example, if an investment bank is representing both the buyer and the seller in a merger, there is a potential conflict of interest. In such cases, investment bankers must ensure that they are acting in the best interest of both parties and that they are not favoring one side over the other. Transparency and disclosure are crucial in managing conflicts of interest and maintaining the trust of clients.

Another ethical consideration in deal making is the duty to maintain confidentiality. Investment bankers often have access to sensitive information about their clients and the deals they are working on. It is essential for investment bankers to respect the confidentiality of this information and not disclose it to unauthorized parties. Breaching confidentiality can not only harm the reputation of the investment bank but also have legal consequences.

Transparency is another important ethical consideration in deal making. Investment bankers must provide their clients with clear and accurate information about the risks and potential rewards of a deal. They should not misrepresent or withhold information that could impact their clients’ decision-making process. Transparency builds trust between investment bankers and their clients and ensures that clients can make informed decisions.

In addition to these ethical considerations, investment bankers must also be mindful of the potential impact of their deals on various stakeholders. For example, a merger or acquisition can result in job losses or changes in company culture. Investment bankers should consider the potential social and economic consequences of their deals and work to minimize any negative impacts. This requires a broader perspective beyond just the financial aspects of the deal.

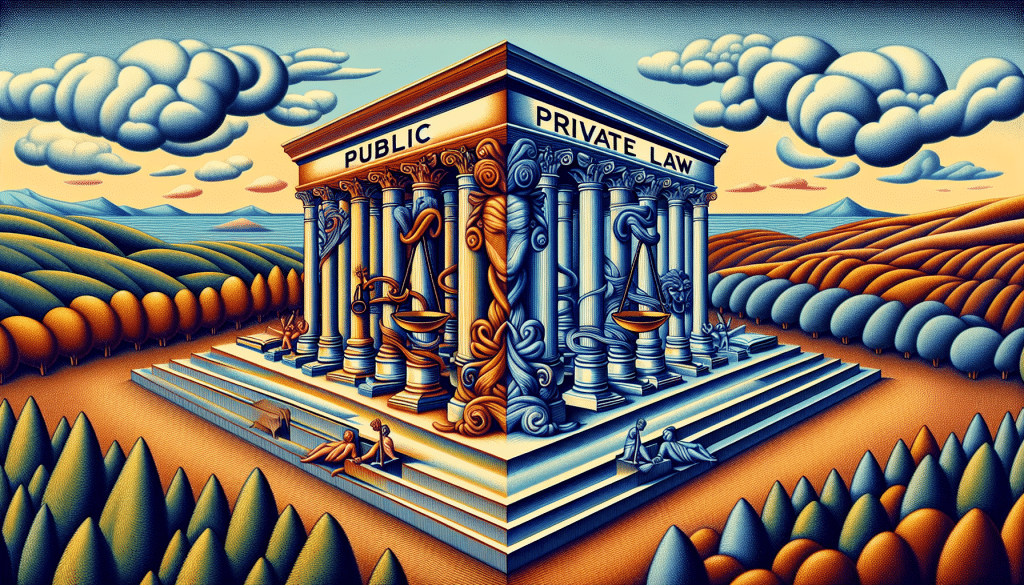

Furthermore, investment bankers must adhere to legal and regulatory requirements in their deal making. They must ensure that they are in compliance with securities laws, antitrust regulations, and other relevant legislation. Violating these laws can have severe consequences for both the investment bank and its clients.

In conclusion, ethical considerations play a crucial role in deal making within the investment banking industry. Investment bankers have a duty to act in the best interest of their clients, manage conflicts of interest, maintain confidentiality, and be transparent in their dealings. They must also consider the potential impact of their deals on various stakeholders and comply with legal and regulatory requirements. By adhering to these ethical considerations, investment bankers can build trust with their clients and contribute to the long-term success of their businesses.

Responses